san francisco gross receipts tax 2021 due dates

Watch our instructional videos on filing your 2021 Annual Business Tax. Important Dates for Business Owners.

San Francisco Set To Begin 2021 With Gross Receipts Tax Increase New Levy On Overpaid Executives To Take Effect In 2022 Andersen

The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively.

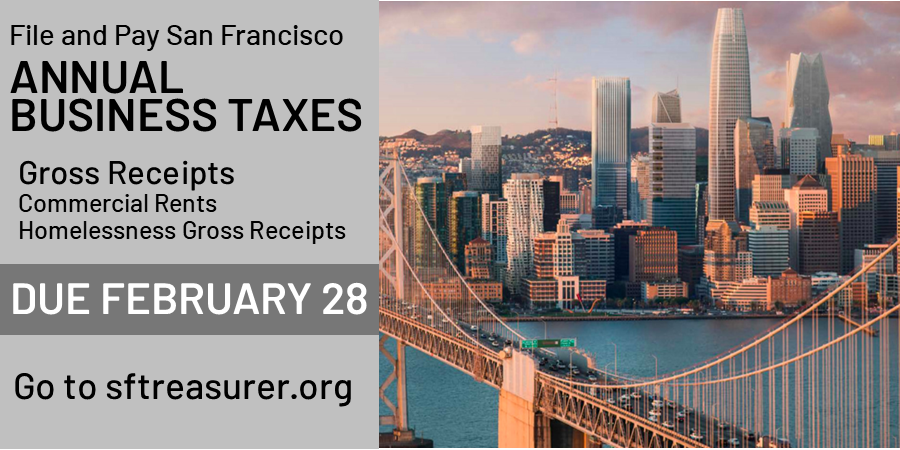

. May 1st thru june 15 prepayment. Quarterly prepay sales tax due on february 24 2022. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

Tax filings are required to be completed online in most. Estimated tax payments due dates include April 30th August 2nd and November 1st. The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6 2012.

City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date.

2022 S-78 current2016 Building Inspection Codes Planning Zoning Map Archive March 1 2022 Planning Zoning Map Archive February 1 2022 Planning Zoning Map Archive January 1 2022 Planning Zoning Map Archive December 1 2021 Planning Zoning Map Archive November 1 2021 Planning Zoning Map Archive October 1 2021 Planning Zoning Map Archive. Due Dates for Quarterly Installment Payments. Annual Business Tax Returns 2021 The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

The Office of Treasurer and Tax Collector will publish Gross Receipts Tax Rate and Payroll Expense Tax Rate by 91 of each year. The calendar tax year is 12 consecutive months beginning January 1 and ending December 31. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due.

This tax adds to San Franciscos broader gross receipts tax which applies rates ranging from 016 percent to 065 percent for firms with more than 1 million in gross receipts. The yellow 2020-2021 certificate is valid through the deadlines above. The filing obligation and tax rates for all three taxes vary based on the industry the business is involved with.

Beginning in tax year 2019 the Return will also include the Early Care and Education Commercial Rents. The three taxes are the San Francisco Gross Receipts Tax the Homelessness Gross Receipts Tax and the Commercial Rents Tax. Important filing deadlines include the san francisco gross receipts filing deadline of february 28 and the april 1st business property tax filing.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. Estimated business tax payments are due April 30th July 31st and October 31st. A fiscal tax year is 12 consecutive months ending on the last day of any month except December.

California Sales Tax Due Dates 2022. San Franciscos Payroll Expense. Additionally businesses may be subject to up to three city taxes.

The deadline for paying license fees for the 2022-2023 period is March 31 2022. Such as those at the San Francisco International Airport and the. The due date for filing the san francisco 2021 annual business tax sf abt return which includes reporting and payment of 1 the gross receipts tax grt or administrative office tax aot 2 the homelessness tax hgrt or the homelessness administrative office tax haot and 3 the commercial rents tax crt is february 28 2022.

Treasurer Tax Collector. San Franciscos 2020 Business Registration Tax Return originally due June 1 2020 and extended to March 1 2021 has been further extended to April 30 2021. The fiscal year for the City and County of San Francisco starts on July 1 and ends on June 30.

The San Francisco Annual Business Tax Return Return includes the Gross Receipts Tax Payroll Expense Tax and Administrative Office Tax. Annual Business Tax Returns 2021 File by Feb. To provide COVID-19 pandemic relief the 2020 filing and final payment deadline for these taxes has been moved to April 30 2021 and the deadline to make payment of license fees both for the 2020-2021 and 2021-2022 periods has been moved to November 1 2021.

The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office Tax AOT 2 the Homelessness Tax HGRT or the Homelessness Administrative Office Tax HAOT and 3 the Commercial Rents Tax CRT is February 28 2022. For taxpayers with less than 25 million of taxable gross receipts the due date has been extended. Deferral of Regulatory License Fees.

Business with 25 million or less in San Francisco gross receipts have the deadline deferred to November 1 2021 while businesses with more than 25 million in gross receipts had their deadline deferred to June 30 2021. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes.

The deadline to file tax returns for all three taxes is February 28 2022. The Ordinance replaces the existing payroll expense tax on the privilege of doing business in San Francisco with a tax that is based on gross receipts from business conducted within the city. To avoid late penaltiesfees the returns must be submitted and paid on or before Feb.

Residential Landlords with no more than 2000000 in gross receipts in 2021 are exempt from estimated quarterly business tax payments in 2022 and if their gross receipts in 2021 were less than or equal to 2000000 will not receive an estimated business tax payment notice. Motor vehicle fuel tax suppliers september 2022 prepayment due. Beginning in 2014 the City of San Francisco implemented reforms to its then-current.

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts calculated on the 2020 Annual Business Tax Return due April 30 2021. The Annual Business Tax Return due date has been extended by the Ordinance from March 1 2021 1 to April 30 2021. The 2021 filing and final payment deadline for these taxes is February 28 2022.

Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018. Due date to file Form 571-L Business Personal Property Statement. To avoid late penaltiesfees the returns must be submitted and paid on or before February 28 2022.

San Franciscos doing business nexus standards include maintaining a fixed place of business.

Annual Business Tax Returns 2021 Treasurer Tax Collector

San Francisco Gross Receipts Tax

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

What Is Gross Receipts Tax Overview States With Grt More

Due Dates For San Francisco Gross Receipts Tax

Key Dates Deadlines Sf Business Portal

Annual Business Tax Return Treasurer Tax Collector

Working From Home Can Save On Gross Receipts Taxes Grt Topia

Jose Cisneros Treasurersf Twitter

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Overpaid Executive Gross Receipts Tax Approved Jones Day

Homelessness Gross Receipts Tax

Tax News Views Podcast Gross Receipts Deloitte Us

California San Francisco Business Tax Overhaul Measure Kpmg United States

Jose Cisneros Treasurersf Twitter